Among all professionals, the doctors hold the highest respect. In many cases, their financial needs are almost as critical as their medical equipment. We know that the main priority of a doctor is caring for their patients—but what about their financial needs?

No worries! You just take care of your patients, and Personal Loan Guru is here to fulfill your financial needs.

Whether you're a doctor, physician, dentist, or other medical professional seeking financial support to achieve your personal or professional goals, visit Personal Loan Guru!

PLG is here to assist you in managing your finances and provide loans from different banks and NBFCs (non-banking financial companies) to medical professionals to expand their practice, upgrade medical equipment, or manage personal expenses. We offer the best personal loan for doctors with low interest, minimal documentation, a quick process, and easy approval.

Interest Rates of "Doctor Loan" offered by Various Banks & NBFCs

| Bank Name | Interest Rate for Doctor Salaried |

Interest Rate for Doctor in Practice |

One Time PF |

Repayment Tenure |

|

|---|---|---|---|---|---|

| Bajaj | 13.25% Onwards | 13.50% Onwards | 1.25% | 8 Years | APPLY NOW |

| L&T Finance | 10.99% Onwards | 11% Onwards | 1% | 4 Years | APPLY NOW |

| Tata | 11% Onwards | 12% Onwards | 1% | 5 Years | APPLY NOW |

| Kotak | 12% Onwards | 11.75% Onwards | 10,000 | 5 Years | APPLY NOW |

| Bajaj Market | 12.75% Onwards | 12.75% Onwards | 1% | 7 Years | APPLY NOW |

| HDFC | 10.75% Onwards | 10.75% Onwards | 7,999 | 5 Years | APPLY NOW |

| Chola | 13.50% Onwards | 13.50% Onwards | 2% | 5 Years | APPLY NOW |

| IDFC | 13.50% Onwards | 10.75% Onwards | 1% | 5 Years | APPLY NOW |

| Godrej Capital | 14% Onwards | 14% Onwards | 2% | 5 Years | APPLY NOW |

| Yes Bank | 14% Onwards | 13% Onwards | 1.50% | 5 Years | APPLY NOW |

| Aditya Birla | 14% Onwards | 14% Onwards | 2% | 5 Years | APPLY NOW |

| ICICI | 10.50% Onwards | 12% Onwards | 1% | 5 Years | APPLY NOW |

| Axis Bank | 11.50% Onwards | 13% Onwards | 2% | 5 Years | APPLY NOW |

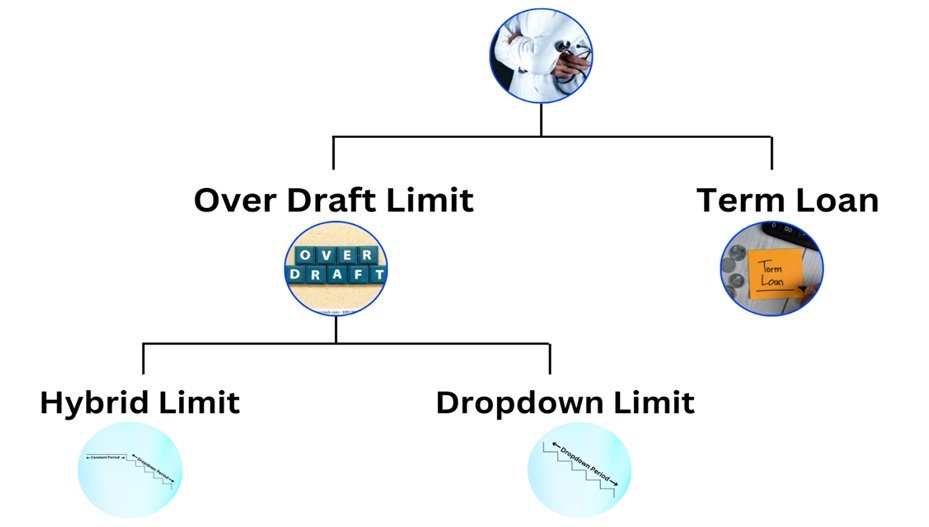

Doctor Loan Variants offered by Multiple Banks

| Bank Name | Term Loan | Hybrid OD Limit | Dropdown OD Limit | Overdraft Limit | |

|---|---|---|---|---|---|

| Bajaj | APPLY NOW | ||||

| L&T Finance | APPLY NOW | ||||

| Tata | APPLY NOW | ||||

| Kotak | APPLY NOW | ||||

| Bajaj Market | APPLY NOW | ||||

| HDFC | APPLY NOW | ||||

| Chola | APPLY NOW | ||||

| IDFC | APPLY NOW | ||||

| Godrej Capital | APPLY NOW | ||||

| Yes Bank | APPLY NOW | ||||

| Aditya Birla | APPLY NOW | ||||

| ICICI | APPLY NOW | ||||

| Axis Bank | APPLY NOW |

About Doctor Loan and Its variants

Apply for Doctor Loan with PLG

Why Choose us for Doctor Loans?

At Personal Loan Guru, we negotiate hard with 30+ Top Banks and financial instutions NBFCs and compare all offers, helping you find the best deal which is perfect financial solution with ease. We analyze your profile, financial situation and requirements, compare interest rates of top banks & financial institutes of India, and choose the best plan with the lowest ROI & best offer for you and provide you a customized financial solution to meet your financial needs, and we ensure you get the most suitable option. Whether you need a personal or professional loan, we make sure that the loan process is quick, simple, and hassle-free, helping you achieve your financial goals with the best possible deal.

Partnership with 30+ Banks & NBFCs

Looking for the best personal loan options? Personal Loan Guru (PLG) collaborates with 30+ leading banks and NBFCs to provide you with the most competitive loan offers. We compare all opportunities and eligibility to apply for a loan and select the top 5 deals among them.

5 Lowest Rate of Interest

At Personal Loan Guru, we shortlist the best 5 personal or professional loan offers across banks and NBFCs to help you get the lowest possible rate of interest (lowest ROI).

Cashback Offers

Apply for a loan at Personal Loan Guru and enjoy guaranteed cashback as a special benefit! When you apply for doctor loan to fulfil your personal or professional financial requirements at Personal Loan Guru, you will be guaranteed a special cashback offer on the approval of your loan.

Easy Repayment

Enjoy easy EMI options and flexible repayment options at Personal Loan Guru. At PLG, you can easily repay your personal or professional loan with pocket-friendly EMIs across flexible tenures ranging from 12 to 84 months. You can choose a convenient EMI plan that fits your budget and enjoy a stress-free repayment experience customized to meet your financial requirements.

Easy Apply

There is just a 6-click process to apply for a loan for doctors at Personal Loan Guru. Doctors can apply for loans in just 6 simple clicks with Personal Loan Guru. You can easily apply through website: www.personalloanguru.com/doctor-loan

Hassle Free

Minimal Documents Required to apply at PLG. Personal Loan Guru offers you loans with minimal document requirements and zero complications.

Business Loan for Doctors in India

Whether you’re doing your practice or an experienced doctor wants to purchase medical equipment, needs to renovate your clinic, or needs to manage your day-to-day expenses, the expert team of Personal Loan Guru is here to fulfil your financial needs. At PLG, we recognize the unique financial requirements of medical professionals and provide customized loan for doctors. Our goal is to make it easier for you to manage your finances with ease and also make it easy for you to take care of your patients.

How to Apply for a Doctor Loan?

Uses of Professional Loan for Doctor

Setting Up a New Clinic

Starting a new clinic is an exciting venture but can be financially demanding. From leasing or purchasing a suitable property to outfitting it with necessary furniture and fixtures, the initial setup costs can be substantial. Our doctor loans provide the capital required to establish your clinic without compromising on quality. With adequate funding, you can create a professional and welcoming environment for your patients from day one.

Upgrading Medical Equipment

Staying abreast of the latest advancements in medical technology is crucial for providing the best care. Investing in new medical equipment, whether it's for diagnostic imaging, treatment, or patient care, can significantly enhance the quality of your services. Our doctor loans offer the financial support needed to purchase or upgrade medical equipment, ensuring your practice remains at the forefront of medical innovation.

Managing Working Capital

Maintaining a steady cash flow is essential for any medical practice. There are times when you may need additional working capital to cover operational expenses, manage payroll, or handle unexpected costs. Our doctor loans can provide the liquidity needed to keep your practice running smoothly, allowing you to focus on patient care rather than financial management.

Expanding Your Practice

As your practice grows, you may need to expand your facilities or open additional locations. Whether you're planning to renovate your current clinic or start a new branch, our doctor loans can provide the necessary funding to support your expansion plans. By securing a loan tailored to your needs, you can invest in your practice's growth and reach a larger patient base.

Continuing Education and Professional Development

Continuous learning is essential in the medical field. If you're considering further specialization, attending conferences, or pursuing advanced certifications, our doctor loans can cover the costs associated with your professional development. Investing in your education not only enhances your skills but also benefits your patients and practice.

PLG is committed to supporting doctors and medical professionals in achieving their financial goals. Our doctor loans are designed to provide the necessary financial assistance to help you set up, expand, and enhance your practice. With competitive interest rates, flexible repayment options, and a straightforward application process, we make it easier for you to access the funds you need. Let us help you take your medical practice to new heights—apply for a doctor loan with PLG today and experience the difference.

Bank Partners